Introduction

Choosing the right type of business financing can feel overwhelming, especially when faced with two common options: the business line of credit and the term loan.

Both offer unique benefits, but each serves a different purpose. In this article, we’ll break down the key differences to help you decide which one is the best fit for your business in 2025.

💳 What is a Business Line of Credit?

A business line of credit (LOC) gives you access to a set amount of money that you can draw from as needed—similar to a credit card.

✅ Best for:

- Managing cash flow

- Covering short-term expenses

- Seasonal businesses

- Emergency funds

💡 Features:

- Revolving credit (reusable after repayment)

- Pay interest only on what you use

- Flexible repayment terms

- Typically lower amounts than term loans

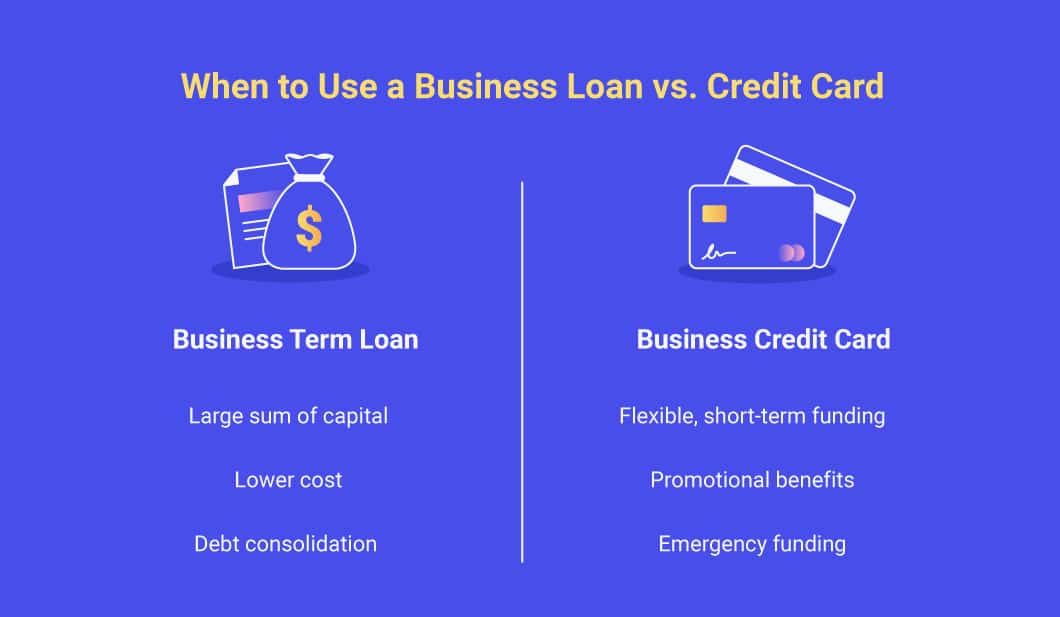

💵 What is a Term Loan?

A term loan provides a lump sum of money upfront, which you repay over a set period with fixed or variable interest.

✅ Best for:

- Major purchases

- Business expansion

- Equipment or real estate

- Long-term investments

💡 Features:

- Fixed repayment schedule

- Interest on the full amount

- Higher loan amounts possible

- May require collateral

🆚 Line of Credit vs Term Loan: Quick Comparison

| Feature | Line of Credit | Term Loan |

|---|---|---|

| Funds Access | As needed | Lump sum |

| Interest Charged On | Amount used | Full loan amount |

| Repayment | Flexible | Fixed monthly payments |

| Reusability | Revolving | One-time |

| Ideal For | Short-term needs | Long-term projects |

| Approval Time | Fast | Slightly longer |

| Collateral Required | Sometimes | Often |

💼 When to Use a Line of Credit

Choose a business LOC if you:

- Have frequent short-term cash gaps

- Need to pay for inventory, payroll, or emergencies

- Want on-demand access to funds

- Don’t need a large loan all at once

🏗️ When to Use a Term Loan

A term loan makes more sense when you:

- Are investing in long-term assets

- Need a large lump sum

- Can commit to regular monthly payments

- Want predictable repayment over time

💬 Real-World Example:

Sarah’s Bakery uses a line of credit to manage seasonal ingredient costs.

Mike’s Tech Startup takes a term loan to purchase expensive hardware and fund expansion.

Both are right—depending on their business needs.

🧠 Pro Tip:

Some businesses use both:

- A term loan for expansion

- A line of credit for daily operations

This combo keeps you funded for the long haul and prepared for short-term surprises.

🔗 Internal Linking Suggestions:

- Link to Article #6 (secured vs unsecured loan)

- Link to a business funding calculator

- Recommend your “Get Prequalified” page if available

✅ Final Thoughts

Understanding the difference between a business line of credit and a term loan helps you make smarter decisions. If flexibility is your top priority, a LOC may be perfect. But if you need serious funding with structure, a term loan might be the better move.

Always choose based on your goals, cash flow, and repayment comfort.