Introduction

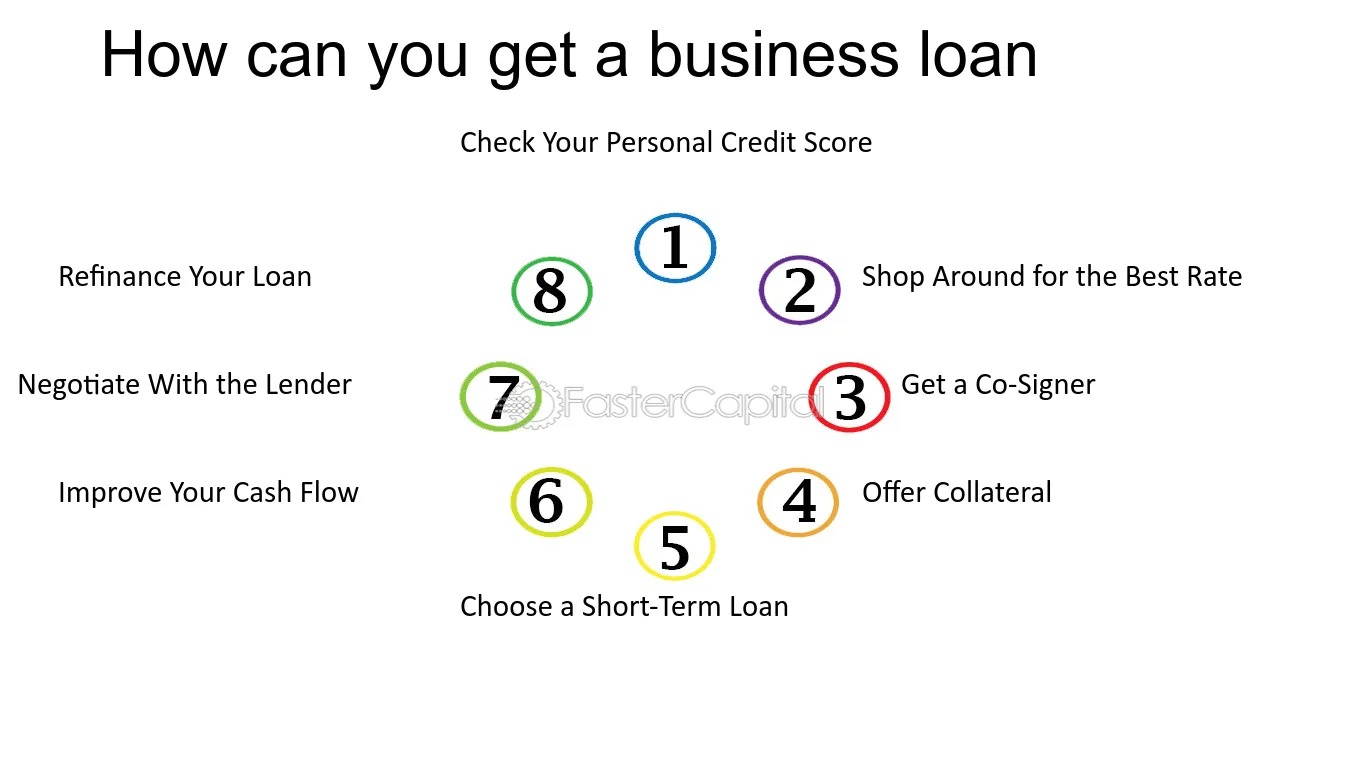

High-interest rates can turn a helpful business loan into a costly burden. Luckily, there are smart ways to lower your business loan interest rate and keep more money in your pocket.

Here are the top 7 tips every business owner should know before applying in 2025.

1. Improve Your Credit Score

Lenders reward borrowers with higher credit scores by offering lower interest rates.

Action Step:

Pay down debts, fix errors on your credit report, and maintain a strong payment history.

2. Offer Collateral

Secured loans with collateral usually come with lower interest rates since the lender’s risk is reduced.

Example:

Equipment, property, or inventory can serve as collateral.

3. Choose the Right Loan Type

Different loans have varying interest rates. For example, SBA loans often have lower rates than traditional bank loans.

Tip:

Research options before applying.

4. Negotiate with Lenders

Don’t accept the first offer. Ask lenders for better rates, especially if you have a strong business track record.

5. Shorten the Loan Term

Shorter loan terms usually mean lower interest rates, though monthly payments will be higher.

6. Increase Your Down Payment

Lenders see a bigger down payment as a sign of commitment, which can lower your interest rate.

7. Maintain Strong Cash Flow

Show consistent positive cash flow to demonstrate your ability to repay, reducing perceived risk.

🔗 Internal Linking Suggestions:

- Link “improve credit score” to Article #9 (loan approval tips)

- Link “secured loans” to Article #6 (secured vs unsecured loans)

- Link “SBA loans” to a dedicated SBA loan guide if available

✅ Final Thoughts

Lowering your business loan interest rate takes some effort but results in big savings. Start with your credit, understand your options, and negotiate confidently to get the best deal possible.